March 2025

Why Are California Gas Prices So High?

If you’ve ever filled up your tank in California, you know how high California gas prices can be as you watch your hard-earned money disappear at the pump. And for the hundreds of super commuters who drive long distances to keep California’s industries moving—whether in agriculture, construction, manufacturing, or other blue-collar jobs—the high gas prices make an already tough commute even tougher.

But why is gas so expensive here? It’s not just about oil prices. State taxes, regulations, and supply issues also contribute to California’s high gas prices. Let’s break it down and talk about what can be done to bring relief to all Californians.

Breaking Down California’s Gas Taxes*

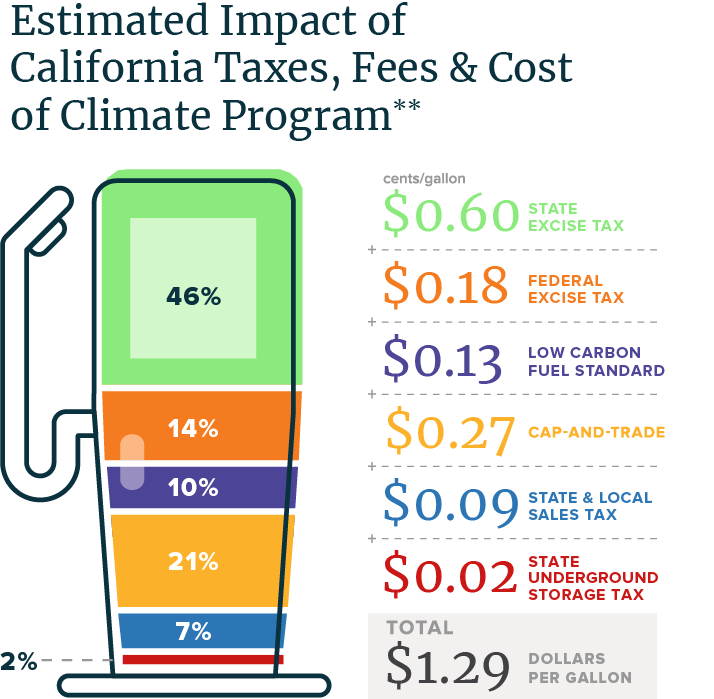

While the cost of crude oil is often blamed for high California gas prices, the truth is that several factors contribute to high gas prices, including added California gas taxes, fees, and California fuel policies that drive up the price at the pump. Here’s where that extra money goes:

Excise Taxes: California gas taxes are some of the highest in the country, adding over $0.60 per gallon.

Cap-and-Trade Fees: Fuel companies must pay for carbon emissions, which tack on about $0.27 per gallon.

Low Carbon Fuel Standard (LCFS): This program requires cleaner-burning fuels, but the added compliance costs are passed down to consumers. The cost of LCFS is about $0.13 per gallon.

Local Taxes: Depending on where you live, local sales taxes can drive up California’s gas prices even more.

Did You Know? About $1.30 of every gallon you pay at the pump goes to taxes and regulatory fees. This raises questions about whether these policies are truly in the best interest of consumers.

All these added California gas taxes and regulatory fees contribute to drive up prices at the pump, making California gas prices the most expensive. For hardworking people who rely on their vehicles every day, it means more money out of their pockets just to get to work and provide for their families.

How California Gas Prices Impact Residents

It’s not just about filling up your tank—high California gas prices touch every part of daily life. California’s gas prices drive up transportation expenses, which can make groceries and other goods and services more expensive. For families already struggling to make ends meet, this means they must spend even more of their hard-earned money on many daily expenses.

California Fuel Policies vs. Affordability

California’s aggressive climate goals, which aim to cut greenhouse gas emissions by 40% below 1990 levels by 2030, are part of the reason behind high California gas prices. While these goals are well intended, many of California’s fuel policies designed to achieve climate goals place a heavy financial burden on residents.

These policies disproportionately impact working-class communities, particularly those who rely on driving for their jobs and face the burden of high prices at the pump daily. As organizations like CalMatters point out, California needs to find a balance between environmental progress and economic fairness to avoid burdening those who can least afford it.

Take Action

High California gas prices aren’t just about the cost of oil— in addition to supply and demand, they’re also driven by taxes, regulations, and environmental policies that put an unfair strain on lower-to middle-class communities. While these policies may have been crafted with good intentions, they are making life harder and more expensive for millions of residents. We need solutions that balance sustainability and affordability so that everyone can thrive.

The next time you fill up, remember—it’s not just the price of oil that’s pushing costs up. By understanding what’s really driving these high California gas prices, we can push our legislators for fairer, more effective policies that don’t leave working families behind.

If you’re frustrated with how California’s energy policies are affecting you, we want to share your story and urge policymakers to adopt fairer, more affordable policies. Join us at https://levantatuvoz.org/join-us/

*Source: U.S. Energy Information Administration; California Department of Tax and Fee Administration; Low Carbon Fuel Standard based on OPIS methodology; Cap-and-Trade based on most recent Auction Settlement Price for California Carbon Allowances. All information accessed in January 2025.

**Source: U.S. Energy Information Administration; California department of Tax and Fee Administration; Low Carbon Fuel Standard based on OPIS methodology; Cap-and-Trade based on more recent Auction Settlement Orice for California Carbon Allowances. All information accessed in January 2025. Disclaimer: This infographic is based on average historical gas prices and is not a forecast of future gas pricing. The basic rules of supply and demand have an impact on the price of gasoline. Additionally, local taxes and fees also account for the cost of gasoline to consumers. This figure assumes all businesses pass on the entire cap and invest costs, however, WSPA does not have knowledge on whether individual companies pass on the costs and does not discuss or comment on whether they should do so.

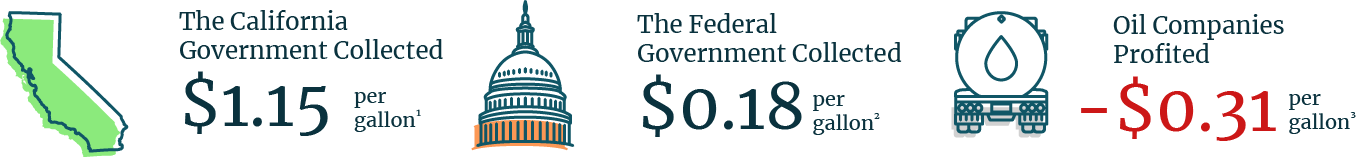

1. This figure represents the sum of Statue Excise Tax, State and Local Sales Taxes and State Underground Storage Tank Fee collected by the California Department of Tax and Fee Administration; Low Carbon Fuel Standard based on OPIS methodology; Cap-and-Trade (Fuels under the cap) based on most recent Auction Settlement Price for California. 2. U.S. Energy Information Administration. How much tax do we pay on a gallon of gasoline and one gallon of diesel fuel? Accessed: January 2024. 3. California Energy Commission reported refinery profits for December 2023.

Share Your Voice

Our voices matter when creating energy policies that directly impact the livelihoods of Latino communities.

"*" indicates required fields

Share Your Voice

Our voices matter when creating energy policies that directly impact the livelihoods of Latino communities.

"*" indicates required fields

Paid for by Western States Petroleum Association

Pagado por Western States Petroleum Association